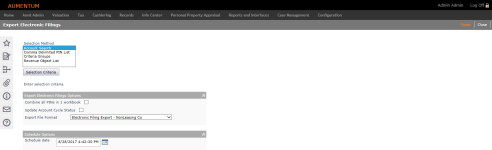

Export Electronic Filings

Navigate:  Personal Property Appraisal > Batch Processes > Electronic Filing > Export

Personal Property Appraisal > Batch Processes > Electronic Filing > Export

Description

NOTE: This task may not apply to your jurisdiction.

Use this task to export large personal property account renditions to an Excel spreadsheet using either a personal property account search or a listing of PINs to generate the report.

Aumentum account and asset data for large filings, typically for large business accounts, can be generated to Excel format, which can then be emailed/mailed to the property owner. Owners of business assets are provided electronic rather than paper filing at the owners' request. Personal filings can use either I-File or paper. The jurisdiction sets a flag on the account to indicate electronic filing.

SETUP: See Personal Property Appraisal, Personal Property Appraisal Setup, and Electronic Filing Export for any applicable prerequisites, dependencies and setup information for this task.

Steps

-

On the Export Electronic Filings screen, click to highlight an item in the Selection Method box and click Selection Criteria.

-

Account Search – Opens the Select Accounts screen on which you can define search criteria and generate a row count based on the criteria. Click Previous to return to the Export Electronic Filings screen.

-

Common Delimited PIN List – opens the Search PIN List screen on which you can enter one or PINs and generate a row count based on the PINs entered. Click Previous to return to the Export Electronic Filings screen.

-

Criteria Groups – Opens the Search Criteria Group List screen on which you can select the tax year and criteria group if a group has been created for this process. Click Previous to return to the Export Electronic Filings screen.

Click here to learn how to set up a criteria group

Click here to learn how to set up a criteria group

- Click Configuration > Criteria Groups.

- On the Set Up Criteria Groups screen, select Personal Property Batch Criteria from the Criteria process code drop-down list.

- Define the remaining data as applicable and click Save.

-

Revenue Object List – Opens the Select Revenue Object List screen on which you can select the tax year and revenue object list. Click Previous to return to the Export Electronic Filings screen.

-

In the Export Electronic Filings Options panel, select the checkbox next to Combine all PINs in 1 workbook (optional; by default, PINs are exported into separate workbooks), and select the checkbox next to Include all PINS on 1 tab (optional; checkbox appears when you select Combine all PINs in 1 workbook).

-

Optionally, select the checkbox next to Update Account Cycle Status. This is the cycle status selected and displayed on the Maintain Personal Property Accounts screen.

-

If you select the checkbox, an additional field is displayed. Make a selection from the New cycle status drop-down list.

-

Make a selection from the Export File Format drop-down list.

Click here to learn how to set up the file format

Click here to learn how to set up the file format

- Click Configuration > Application Settings.

- On the Maintain Application Settings screen, select Effective Date from the Setting type drop-down list, and select Personal Property from the Filter by module drop-down list.

- Locate Electronic Filing Export Format Default and click Edit.

- In the Setting Value field, enter a file extension (for example, .xls or .csv) and click Apply.

- Click Save in the Command item bar.

-

In the Schedule Options panel, enter or select a schedule date.

-

Click Finish to generate the spreadsheet.

-

Click Info Center > Batch Processes.

- On the Monitor Batch Processes screen, click on the process in the grid.

- On the View Batch Process Details screen, click on the file name in the File panel to open it.

- Click Configuration > Application Settings.

- Select Effective Date from the Setting type drop-down list, and Personal Property from the Filter by module drop-down list.

- Locate Electronic Filing Export Sort - PIN, EntryCd and DatePurchased and click Edit.

- In the Setting Value column, select the checkbox and click Apply.

- Click Save in the Command Item bar.

-

Click Close to end the task.

Click here to learn how to sort the file

Click here to learn how to sort the file